Has the Fed Hiked Too Far?

Last Wednesday the Federal Reserve raised interest rates by .25% to a range of 5%-5.25%. The chart below provides context on just how aggressive the Fed has been in this rate-hiking cycle compared to the previous five cycles. In 2022, the Fed had to act aggressively, as they had been far too loose for far too long, resulting in a 40-year high in inflation.

Last December we pointed out that the Fed had finally caught up to and surpassed the yield on the 2-year Treasury for the first time in this rate-hike cycle. Here is what we said:

Many investors believe the 2-year Treasury is a good barometer of where the Fed Funds rate should be. By that line of thinking, throughout 2022 you can see that the Fed has been behind the curve. However, that has now changed, with the Fed Funds rate now being higher than the 2-year Treasury. The reason this matters is that historically the Fed keeps interest rates too low for too long and then they compound their mistake by overtightening, which then sends the economy into a recession.

Fast-forward five months, the Fed has continued to increase rates even as the yield on the 2-year Treasury is now much lower than the Fed Funds rate. The bond market, which was telling the Fed last year that they were way behind, is now screaming to the Fed that they should be cutting rates. We are not in that camp yet, but let’s examine more evidence that argues the most recent hikes may have been a mistake.

Regional Banks

We have discussed what led to the bank failures of Silicon Valley, Signature and First Republic in our previous three posts this year. First Republic was the most recent failure, with most of its deposits being acquired on the cheap by JP Morgan. JPM’s CEO, Jamie Dimon, stated that with the purchase “this part of the crisis is over.”

Then, just days later, during his press conference Fed Chair Powell shared similar thoughts. From The Hill:

Federal Reserve Chairman Jerome Powell indicated Wednesday that the period of bank failures that have rattled markets and the economy has come to an end.

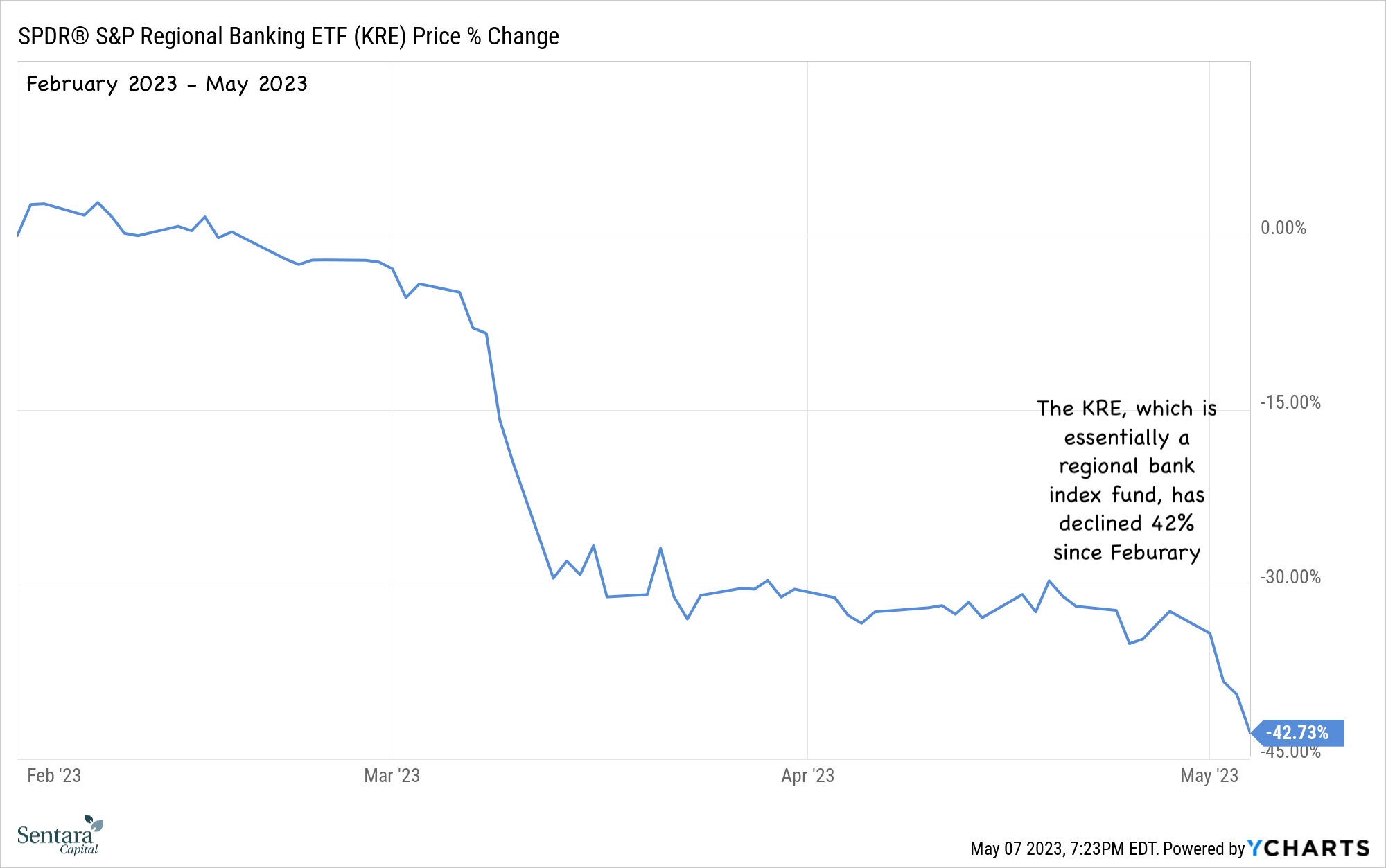

The issue with Dimon and Powell's remarks is that the majority of regional banks' stock prices have yet to give the all-clear. As shown in our next chart, the KRE - a fund that tracks the stock prices of 144 regional banks - continued to decline even after Dimon and Powell's statements. In fact, the KRE plummeted by 10% in the following four trading hours after the Fed’s interest rate hike. This was a significant move for an index fund within such a short time frame, and we believe it reflected investors' unease with Powell's decision to raise rates while showing little concern for additional stress on regional banks.

Inflation

Looking at three key inflaton gauges, it is clear that inflation has continued to decrease across the board. This trend is most notable in the Producer Price Index (PPI), which measures wholesale inflation and has fallen from a high of 11.66% to 2.75% at present. Although the PPI, CPI, and PCE are all still above the Fed's 2% target, the Fed has made significant progress in addressing inflation. In the coming months, inflation is expected to continue to decrease, thanks to factors such as a 15-year high in interest rates, the Fed's $95 billion/month balance sheet reduction program (QT), and a tightening of credit from regional banks.

Earnings

As the first quarter earnings season winds down, 79% of companies have exceeded earnings estimates, which is the highest rate since the fourth quarter of 2021. Better-than-expected reports have come from the likes of Microsoft, Apple, Visa, Mastercard, Pepsi, Chipotle, Lululemon, JP Morgan, Royal Caribbean, Uber, Procter & Gamble, Humana and Lockheed Martin. Many of these companies are consumer-facing and thus are benefiting from the strong consumer we detailed last week.

The fact is that the economy has held up better than expected so far, despite the most aggressive Fed tightening cycle in decades. The consumer has benefited from a strong jobs market and healthy balance sheets. Since this has been an income-driven expansion, rather than a credit-driven one, the Fed's rate hikes have not had as significant of an impact on the consumer and the economy as some forecasters expected thus far. However, the regional bank crisis is likely to slow the economy later this year, as fewer loans will be made to consumers and small businesses. This could be good news for the Fed in its fight against inflation. Nevertheless, we are concerned that the Fed is ignoring the bond market's message, as indicated by the spread between the Fed Funds and the 2-year Treasury, as well as the stock market's message, demonstrated by regional bank stocks continuing to make new lows. The good news is that the broader stock market has been able to overcome the poor performance of the KRE. We will keep you posted as developments unfold.